Saudi’s Ceer awards automotive supplier park deal

3 February 2026

Saudi Arabia’s electric car manufacturer Ceer has awarded a contract to build an automotive supplier park next to its electric vehicle (EV) production facility in King Abdullah Economic City (KAEC).

The contract was awarded to Jeddah-based construction firm Modern Building Leaders (MBL).

The automotive supplier park will include production and ancillary facilities for various suppliers and provide the material supply infrastructure for Ceer’s EV plant.

The facilities include:

- Cold stamping, body-in-white assembly and stamping facility – Shin Young (South Korea)

- Hot stamping, sub-frames and axles subsystem supply facility – Benteler Group (Austria)

- Façade and exterior-trim supply facility – JVIS (US)

- Instrument panel, trims and console supply facility – Forvia (France)

- Seat supplier – Lear Corporation (US)

Netherlands-based engineering firm Arcadis is the project consultant, and Pac Project Advisors is the project management consultant.

Ceer retendered the project in September last year.

Ceer project

In February 2024, MEED exclusively reported that the client had awarded a SR5bn ($1.3bn) contract to MBL to build its first EV production plant.

The plant is being constructed in phases at an estimated total cost of about SR7bn ($1.87bn).

The production facility will design, manufacture and sell a range of vehicles for consumers in Saudi Arabia and the Middle East, including sedans and sports utility vehicles.

Ceer is a joint venture of Saudi Arabia’s sovereign wealth vehicle, the Public Investment Fund (PIF), and Taiwan-based Hon Hai Precision Industry Company, which trades as Foxconn internationally.

Ceer is the second EV company to set up a production plant at KAEC.

Ceer signed a land purchase agreement worth SR359m ($95.7m) with master developer Emaar, the Economic City, for land at KAEC.

The 1 million square-metre site is located in Industrial Valley, near King Abdullah Port.

Exclusive from Meed

-

Qatar heads for a growth surge in 2026

Qatar heads for a growth surge in 20263 February 2026

-

Qatar’s strategy falls into place

Qatar’s strategy falls into place3 February 2026

-

Aldar acquires land for upcoming developments in Abu Dhabi

Aldar acquires land for upcoming developments in Abu Dhabi3 February 2026

-

Saudi’s Ceer awards automotive supplier park deal

Saudi’s Ceer awards automotive supplier park deal3 February 2026

-

Morocco awards $482m phosphate mine works contract

Morocco awards $482m phosphate mine works contract3 February 2026

All of this is only 1% of what MEED.com has to offer

Subscribe now and unlock all the 153,671 articles on MEED.com

- All the latest news, data, and market intelligence across MENA at your fingerprints

- First-hand updates and inside information on projects, clients and competitors that matter to you

- 20 years' archive of information, data, and news for you to access at your convenience

- Strategize to succeed and minimise risks with timely analysis of current and future market trends

Related Articles

-

Qatar heads for a growth surge in 2026

Qatar heads for a growth surge in 20263 February 2026

MEED’s February 2026 report on Qatar includes:

> COMMENT: Qatar’s strategy falls into place

> GVT & ECONOMY: Qatar enters 2026 with heady expectations

> BANKING: Qatar banks search for growth

> OIL & GAS: QatarEnergy achieves strategic oil and gas goals in 2025

> POWER & WATER: Dukhan solar award drives Qatar's utility sector

> CONSTRUCTION: Infrastructure investments underpin Qatar constructionTo see previous issues of MEED Business Review, please click herehttps://image.digitalinsightresearch.in/uploads/NewsArticle/15555212/main.gif -

Qatar’s strategy falls into place

Qatar’s strategy falls into place3 February 2026

Commentary

Commentary

John Bambridge

Analysis editorQatar enters 2026 with a rare sense of momentum and confidence, underpinned by the most optimistic growth outlook anywhere in the GCC. With the IMF forecasting real GDP growth of 6.1%, Doha is not just set to improve markedly on its 2.9% expansion in 2025, but to break clear of its regional peers.

Nor is this dynamic a surprise, so much as one rooted in unusually well-aligned fundamentals. Global gas markets have turned decisively in Doha’s favour, with demand growth resuming in 2024 and strengthening through 2025. Natural gas prices have held up far better than crude and are being buoyed by surging energy demand. Yet all of this only complements the long-term planning of QatarEnergy, which locked in the next phase of the country’s hydrocarbons strategy back in 2021. Doha’s spending of a further $20bn on energy infrastructure in 2025 merely underscored its existing strategy.

Developments are also looking bullish in Doha’s non-hydrocarbon economy. Total project awards across all sectors in the past five years have swollen the value of work under execution in Qatar by $39bn. Recent awards in the utilities sector include the 2,000MW Dukhan solar scheme, which will double national solar capacity and boost the clean energy mix. In the construction sector, a pipeline of large infrastructure schemes, including Doha’s expansive plans for its highway and rail networks, promises to restore a more predictable rhythm to the market. Altogether, non-hydrocarbon growth accelerated to a 4.4% year-on-year expansion in the third quarter of last year.

Geopolitically, Qatar has meanwhile emerged from a turbulent period with its strategic position reinforced rather than diminished. Two brushes with wider regional conflict in the past year might have unsettled a less diplomatically agile state. Instead, Doha has leveraged its indispensability – as an energy supplier, mediator and host to key US assets – to secure stronger security guarantees from Washington. Qatar has also emerged as a winner in Syria, where its long-term support for the anti-Assad opposition has translated into substantial current opportunities. Doha-based construction group UCC Holding is now the anchor for two foreign investment deals: one worth $7bn in the energy sector and another worth $4bn in the aviation sector.

None of this is accidental. As with its investments in the gas sector, Doha’s successes today are the result of long-term strategy. And what lies ahead is precisely what the government has been telegraphing for years – LNG expansion, ambitious public spending and a focus on converting today’s gas windfalls into economic resilience. If 2026 does indeed deliver Qatar a standout performance, it will not be because of commodity prices, but because the different pieces of Doha’s plans are all finally falling into place.

MEED’s February 2026 report on Qatar includes:

> GVT & ECONOMY: Qatar enters 2026 with heady expectations

> BANKING: Qatar banks search for growth

> OIL & GAS: QatarEnergy achieves strategic oil and gas goals in 2025

> POWER & WATER: Dukhan solar award drives Qatar's utility sector

> CONSTRUCTION: Infrastructure investments underpin Qatar constructionTo see previous issues of MEED Business Review, please click herehttps://image.digitalinsightresearch.in/uploads/NewsArticle/15512753/main.gif -

Aldar acquires land for upcoming developments in Abu Dhabi

Aldar acquires land for upcoming developments in Abu Dhabi3 February 2026

Abu Dhabi-based real estate developer Aldar Properties has announced the acquisition of several land plots for upcoming developments in Abu Dhabi.

Aldar said that the plots total over 2.3 million square metres (sq m) across Saadiyat Island and Yas Island.

The developer expects to deliver more than 3,000 new residential units on these sites.

On Saadiyat Island, Aldar will build villas and mansions; on Yas Island, it will develop masterplanned communities.

The projects are expected to be formally launched later this year.

This development follows Aldar’s announcement in October last year of a series of major projects across the residential, commercial and logistics sectors in Abu Dhabi, with a combined gross development value of AED3.8bn ($1bn).

Aldar has committed to a new residential community in the Alreeman area of Al-Shamkha, to offer over 2,000 rental units.

On Yas Island, it will deliver 665 residential units to the rental market, including a gated community totalling 217 units.

Additionally, Aldar will develop 448 new apartments on Yas Island as an extension of Yas Residential Village.

On the commercial front, the company will focus on developing office spaces in key business districts across the UAE to meet demand for Grade-A office space.

Aldar will also deliver the UAE’s first Tesla Experience Centre on Yas Island. The facility, spanning more than 5,000 sq m, will include a showroom, service centre, and delivery and operations hall. It is scheduled for completion in 2027.

https://image.digitalinsightresearch.in/uploads/NewsArticle/15555056/main.jpg -

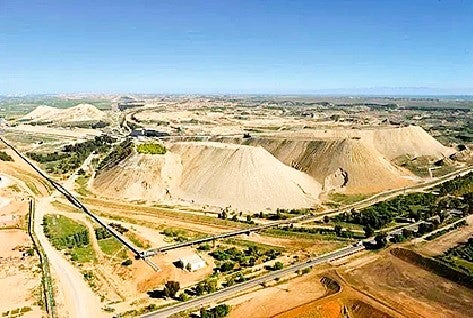

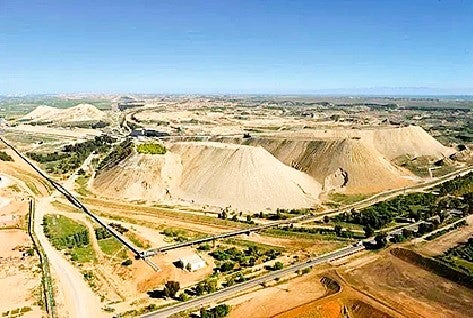

Morocco awards $482m phosphate mine works contract

Morocco awards $482m phosphate mine works contract3 February 2026

Morocco’s Office Cherifien des Phosphates (OCP) has awarded China-based Dalian Heavy Industry Equipment Group a contract to provide phosphate mining services.

The contract, valued at CNY3bn ($482m), is the largest order won by Dalian Heavy Industry Equipment to date, as well as its first engineering, procurement and construction (EPC) deal overseas.

The scope of work includes civil engineering and the supply of core equipment such as stacker-reclaimers, crushers and belt conveyors, as well as integrated services covering the entire process of phosphate mining, beneficiation and material transportation.

Dalian Heavy Industry Equipment has begun work on its contract, which it announced it had won in late January.

Morocco holds the world’s largest phosphate rock reserves, which are used to produce fertilisers and battery materials.

Major phosphate rock deposits are concentrated in the central region around Khouribga, as well as about 120 kilometres south of Casablanca in the Chaouia area.

There are also reserves in the southern Oued Eddahab-Lagouira region near Boucraa and the central-western region around Youssoufia, roughly 80km southeast of El-Jadida in the Doukkala-Abda area.

Prior to the contract award to Dalian Heavy Industry Equipment, OCP awarded another Chinese contractor, Sinoma Construction, an EPC contract for an advanced phosphate processing unit.

The deal, also announced in January, covers the entire project cycle, including design, procurement, construction and commissioning of chemical facilities.

The contract won by Sinoma Construction was also its first contract with OCP in Morocco.

https://image.digitalinsightresearch.in/uploads/NewsArticle/15554922/main0652.jpg -

Read the February 2026 MEED Business Review

Read the February 2026 MEED Business Review2 February 2026

Download / Subscribe / 14-day trial access After years of cautious capital discipline, upstream oil and gas spending is gathering pace across the Middle East and beyond, with 2026 shaping up to be a statement year for investment.

In the Middle East and North Africa (Mena) region, oil companies are pushing ahead with projects deemed critical to long-term energy security, even as oil prices soften. Gas and LNG developments are taking an increasingly prominent role, reflecting rising power demand and the search for lower-carbon fuels.

In the Middle East and North Africa (Mena) region, oil companies are pushing ahead with projects deemed critical to long-term energy security, even as oil prices soften. Gas and LNG developments are taking an increasingly prominent role, reflecting rising power demand and the search for lower-carbon fuels.Globally, North America is set to lead upstream spending through to 2030, but the Middle East remains a close follower, underpinned by low-cost reserves and expanding infrastructure. Read more about what’s driving the next wave of upstream investment here.

Meanwhile, February’s market focus covers Qatar, where Doha is beginning to reap the rewards of its long-term gas investment, strategic spending and diplomatic efforts.

This edition also includes MEED’s latest ranking of GCC water developers. In this package, we look at how the water sector has regained momentum, as the value of public-private partnership and engineering, procurement and construction (EPC) contract awards for Mena water infrastructure schemes reached a record level in 2025.

In the latest issue, we also examine how Iran's recent protests have elevated regional uncertainty, and reveal that GCC contract awards declined by almost a third in 2025. The team also speaks to Mohamed Youssef of AtkinsRealis about demand drivers and challenges for the Canadian EPC specialist; discusses projects market resilience with US engineering firm Parsons' Pierre Santoni; and highlights how DP World underpins Dubai’s economic growth strategy.

MEED’s February edition is also bursting with exclusive leadership insight. Saeed Mohammed Al-Qatami, CEO of Deyaar Development, talks about the need for tomorrow’s communities to move beyond conventional real estate thinking; Ali Al-Dhaheri, managing director and CEO of Tadweer Group, explains why waste-to-energy infrastructure is critical to future energy needs; and Dal Bhatti of global insurance broker Marsh predicts a breakthrough year for Middle East construction in 2026.

We hope our valued subscribers enjoy the February 2026 issue of MEED Business Review.

Must-read sections in the February 2026 issue of MEED Business Review include:

> AGENDA:

> Mena upstream spending set to soar

> Global upstream spending to grow> CURRENT AFFAIRS: Iran protests elevate regional uncertainty

INDUSTRY REPORT:

MEED's GCC water developer ranking

> Regional IWP deals show cautious growth

> Pipeline boom lifts Mena water awards> PROJECTS: Contract awards decline in 2025

> LEADERSHIP: Tomorrow’s communities must heal us, not just house us

> INTERVIEW: Building faster without breaking the programme

> PORTS: DP World underpins Dubai’s economic growth strategy

> INTERVIEW: Projects show resilience

> LEADERSHIP: Energy security starts with rethinking waste

> LEADERSHIP: Why 2026 is a breakthrough year for Middle East construction

> MARKET FOCUS QATAR:

> COMMENT: Qatar’s strategy falls into place

> GVT & ECONOMY: Qatar enters 2026 with heady expectations

> BANKING: Qatar banks search for growth

> OIL & GAS: QatarEnergy achieves strategic oil and gas goals in 2025

> POWER & WATER: Dukhan solar award drives Qatar’s utility sector

> CONSTRUCTION: Infrastructure investments underpin Qatar construction> MEED COMMENTS:

> Kuwait oil tender delays cause problems for key contractors

> International Financial Centre Oman will have to differentiate

> Chinese firm’s Riyadh skyscraper debut signals a shift

> Ras Al-Khaimah sewage award marks key milestone> GULF PROJECTS INDEX: Gulf projects index enters 2026 upbeat

> DECEMBER 2025 CONTRACTS: Middle East contract awards

> ECONOMIC DATA: Data drives regional projects

> OPINION: Trump’s distraction is the region’s gain

> BUSINESS OUTLOOK: Finance, oil and gas, construction, power and water contracts

To see previous issues of MEED Business Review, please click herehttps://image.digitalinsightresearch.in/uploads/NewsArticle/15526442/main.gif